∴

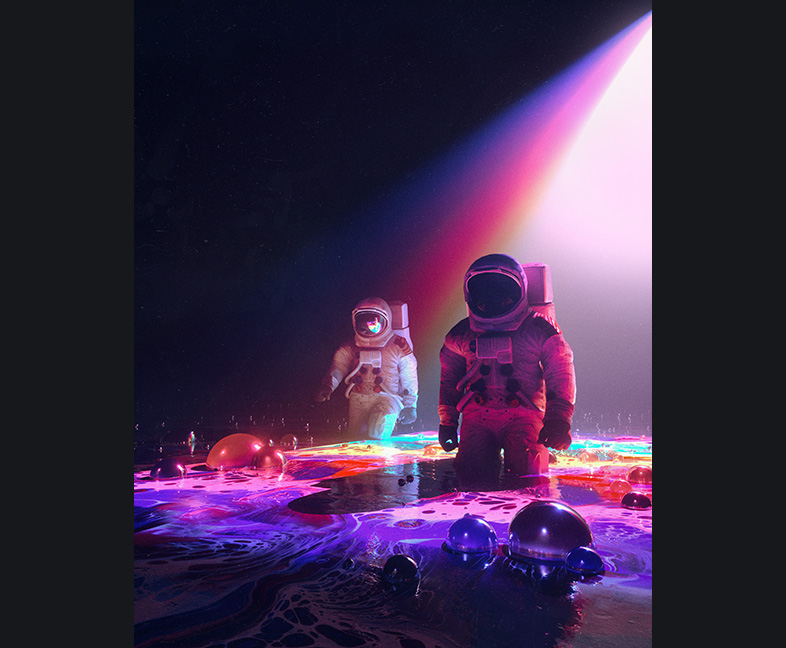

[ Funding big discoveries while knee-deep in the burden /// artist: BEEPLE ]

…

Key Points:

- A cautionary treatise intended to raise the number of debt/deficit hawks in the general population (plus encouragement to teach them young on financial literacy)

- Toxic debt looms alongside society’s “healthy” operational credit/debt (debt-as-tool), the former being loaded with political and systemic poison

- Soaring through a pecuniary Icarus complex, we’re in the right time and place to learn from the severe debt-fueled unveiling of deceptions and tales of the badly burned

- The Boomers aren’t the only ones to blame, they’re just the first to entitle themselves to a level of benefits that is not supported mathematically

- The globalized economy has become inflexible and weighted down by debt traps

- Nicaragua parallel: heavy credit crunches and diluted fiat currencies torment capitalist systems with a circular, tidal nature, provoking the ruined to convert to democratic-socialist or outright Marxist-Leninist inspired visions and counter-aggression

- Stress-testing Franklin & Tytler adages on finance, wealth and poverty 240 years later

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.” —Alexander Fraser Tytler

( or more succinctly )

“When people find that they can vote themselves money, it will herald the end of the republic.” —Benjamin Franklin

. . . … . . .

Can Anybody Fix this Debt Bubble?

Somewhere in the noble-to-selfish range most Americans possess an innate or semi-conscious devotion to a thriving economic system that pulls all sorts of human beings out of poverty and toward success. But we’re rarely in the mood to ponder what it’s like on the way down, in a systemic failure, when the game’s being played wrong. The world is currently way overleveraged. If “all money is a matter of belief,” as Scottish economist Adam Smith famously clarified in 1776—hinting at an enormous, potentially devastating risk—perhaps we’ve overzealously embraced the role of true believers. Without a remedy for excessive lending and money printing, we’re cultivating the policies of resentment and do so at considerable hazard to the future.

The background data is rocky: The United States and other global governments are so indebted they have almost no way to buy their way out of trouble when the next recession hits. World debt ratios flew to unimaginable heights during the stimulus-choked era of super-easy money, and markets are now showing tell-tale signs of late-cycle unsustainability, leaving the international financial system acutely vulnerable to a jump in borrowing costs. Any reversal in our fortunes could be “quick and sharp” says the Bank for International Settlements, the venerable global watchdog and scourge of dissolute practice. Don’t fix it, and let it linger long enough, and it’ll bring us back to memories of some sort of rolling blackout in the economy and worse, the literal kind, when the momentum driving the arc of society has to pause or turn retrograde for a while.

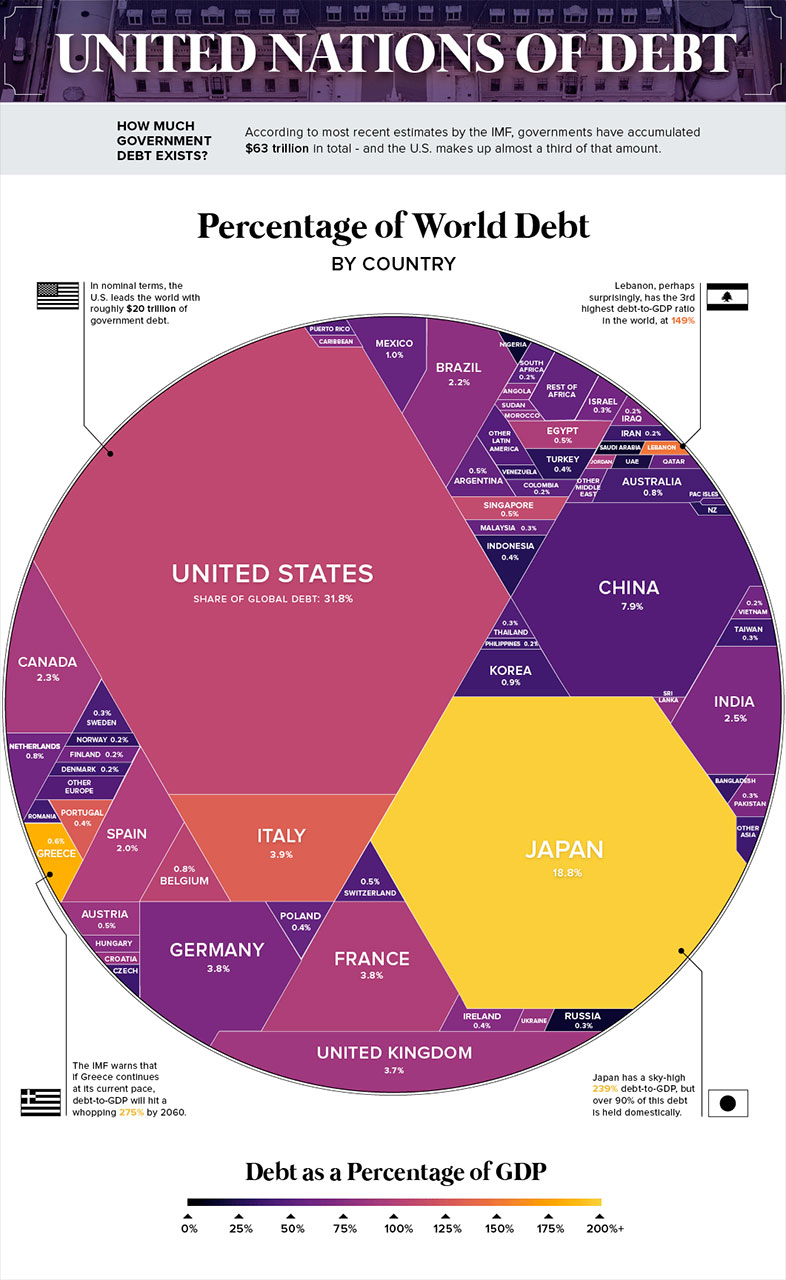

According to the IMF and IIF, global debt is at a record high: the world’s total debt (household, nonfinancial corporate, government and financial debt) has more than doubled (to US$247 trillion) from 15 years ago. Private debt has risen to 225% of the world’s gross domestic product (GDP). No single country or group is to blame, although China accounts for almost three-quarters of the rise in private debt since the 2008-09 financial crises. More than one-third of advanced economies have debt-to-GDP levels greater than 85%—three times more nations than in 2000. Emerging markets (EMs) are also sinking in deeper. Three mountains of debt in particular, could lead to major problems: China’s state-owned banks and enterprises, which are on a borrowing tear to help prop up the country’s high growth rate; epic EM government debt, compounded with EM corporate debt that stood at 105% of EM GDP in 2018. There’s more, but you get the picture.

…

[ How deep into the wilderness do we want to go? ]

…

As the global economy reaches or even exceeds its economic potential, it is time to take advantage of the favorable conditions to put in place a more balanced policy mix to promote a durable expansion. However, we’re not seeing much of that needed action yet, and the path ahead is a narrow one. The dividends of past policies are in evidence and we just enjoyed several vintage years of global activity, which strengthened and broadened well into 2018. Global growth rates were roughly on par with pre-crisis long-term averages, and the expansion was highly synchronized across countries. Unemployment continued to decline, reaching multi-decade lows in a number of economies, including some of the largest.

There was plenty to celebrate when secular stagnation gave way to renewed optimism and a revival of animal spirits. Now we’ve grown curious about limits, and the behavioral economics behind them.

…

…

Jay’s Lament

Here at home, the United States is a $20 trillion economy (as of year-end 2018), and the beacon of free market productivity even if we barely crack the top-20 list of most capitalistic countries. It took us 224 years to become a $10 trillion economy and 18 to double that (by GDP). Federal Reserve Chairman Jerome (Jay) Powell, having inherited a deep-fried central bank balance sheet—one containing the tab and hangover from our collective mistakes 10 years ago—says he’s “very worried” about US debt, a thing he can’t conveniently ignore.

Take a look at the grim tote board that’s slightly more pleasant than cancer statistics: Total US gross national debt is about $22 trillion, of which $16 trillion is owed by the public. The annual US deficit is now believed to be cruising above $1 trillion. In part because of continued rate increases under Powell, the interest cost on that debt is becoming a bigger and bigger load. From the Fed’s standpoint, they’re really looking at a business cycle length as the frame of reference. The long-run fiscal non-sustainability of the US federal government isn’t something that plays relevantly into medium term policy decisions, and neither does the government’s AAA sovereign credit score.

With the 10-year Treasury yield near 3%—roughly half the 50-year average—it’s clear that there remain eager buyers of American debt. The gross national debt is debt held by the public, which subtracts amounts owed by one part of the government to another, such as Treasuries held in the Social Security trust fund. The debt is what we owe. The deficit is the amount by which we go further into the hole each year. Not all deficits are bad. And Modern Monetary Theory, an old concept that often pops up to seek validation in profligate times, goes so far as to ask a contentious question that fiscal conservatives instinctually oppose—do deficits even matter?

…

…

The $1 trillion-plus deficits America ran for four years ending in 2012 helped shore up its financial system and prevent a deep recession from turning into a prolonged depression. Keynesian economics calls for deficit spending and lower taxes during economic slumps to stimulate demand, with the money recouped through surpluses during good years. That last part is no longer happening, however.

Financially we’re peering into the void of a sort of Babylon / Gates of Hell kind of phase, which some observers believe is already nascent and manifest.

…

[ geometric art by Andy Gilmore ]

…

Debt Mystery Solved: Blame the Boomer

I’m late to this party. The internet is already littered with all manner of “blame the Baby Boomer” hit pieces, ignoring the fact that newer people are also doing bad things with debt. Generationally, you can’t just blame the Boomer.

Blame their parents—Depression-era kids—for being given the first opportunity to vote themselves money out of other people’s pockets. FDR kicked off the mass theft “redistribution” of wealth through his great welfare state. Since the Social Security Act back in 1935, peoples’ first priority was to vote in politicians who would protect their sacred cow, protect their financial security and pander to their insecurities of being poor and destitute in old age.

Are Boomers scamming later generations? No. It’s just human nature at work. Everyone is naturally going to promote their own self-interest first. Altruism is a fair-weather pursuit. Boomers just happen to be the first wave of America’s post-WWII supremacy, accumulating wealth in a world without economic competition—and part of the first generation to utilize the vote to pick the pockets of imminent generations to pay for their retirement and health care. They were the first generation to benefit from newly formed government programs such as FHA/VA financing to purchase homes (the one’s they’re now selling at top dollar), finance their college educations (Sallie Mae), promote the force of Big Government and government spending at unimaginable levels, and grow the military industrial complex that now spies on and represses your freedoms, all for the sake of protecting their government-created estates.

Politicians, always seeking to buy votes with your tax dollars, were complicit in the explosion of the welfare state and the Big Guv we know today. They fear a situation where they cannot buy votes. And, Boomers (and Gen Xer’s to a lesser degree) fear losing what they’ve been promised their entire lives by Big Guv—a taxpayer-funded estate they believe they are entitled to, and that you and I are obligated to provide to them at all costs. They are so emotionally vested in this idea of “they’ve earned it,” despite it being mathematically impossible.

…

…

I did the calculation a while back and figured it would take taxing the 138 million or so US taxpayers better part of a century to pay off the national debt from federal tax revenues, much less deal with unfunded liabilities of between three to seven times that amount. That was before the additional trillions of debt approved under Barrack Obama—the man who added more to the national debt than all other presidents combined—plus what we’ve incurred under the auspices of Trump Administration stimulus.

It’s an absolutely hopeless situation. In what was once considered the lunatic fringe of speculation, there seems to be a growing consensus that only something akin to a civil war with Boomers, Xers and Millennials over what they’ll perceive is stealing their “earned” benefits could solve the problem. Since that solution exists at the junction of madness, many functionally refuse to believe it. Nonetheless, raising retirement ages and cutting benefits are only very temporary measures to delaying the inevitable. And, we only have to look to places such as Greece and now Nicaragua (discussed below) to see what happens when you even suggest such mild fiscal reforms.

…

…

I’m Generation X, which in the grand scheme of things is barely out of the Boomer cohort. I think I have enough background research and experience to tell you what to prepare for, a service that some might charge for but I will give away for free. I know these people pretty well and have dealt with them in the financial world and various other sectors for more than 25 years:

1. They are entitled. Not just in attitude, they really believe that their payment of measly contributions into social security, Medicare and other state/federal programs entitles them to a level of benefits that is not supported mathematically.

2. Many of them think you and I are lost, lacking and lesser than they. They believe it is our responsibility to take care of the second-greatest generation. After having their fun in the 1960s, 70s, 80s and 90s, they demand that the young pay for their stuff now.

3. Another bubble à la 2007–2009 is about ready to burst. Along with the implosion of vast tracts of student debt, real estate will crash sometime in 2019–2020 because the younger generation simply doesn’t have the buying power to contend with a frothy housing market, are capable of learning from others’ mistakes, and are backing off the financially-unsustainable lifestyle they saw the Boomers enjoying for decades. Meanwhile, Boomers who are just now recovered from the last global bankster pump-and-dump will want heads to roll when the debt bubble pops again. And, they’ll want even greater assurances from our mostly-impotent “leaders” to protect their nest eggs. If you don’t make every attempt to dissuade the doomsayer in your research and investing techniques, you’ll also recognize what might be the single most important piece of advice…

4. Do not use ERISA plans (IRAs and 401Ks, etc.) to accumulate wealth. Your government knows how many trillions are in those IRS-sanctioned holding structures—in a different light, these can be categorized as tax-entity constructs, not investments. Legislation has already been proposed to legitimize “conditional” government confiscation of the trillions in those funds, and then use it to prop up their balance sheets. They’ve also proposed forced savings (i.e., buying near-worthless government debt at minuscule interest rates). Do a little Googling and you’ll find proposals a decade old to do such things. Try to take your money out after such egregious legislation is passed and surely you’ll face more than just a 10% early withdrawal penalty. I’ve yet to heed this piece of advice on my own, having assumed a casino-like mentality about the money on that table, having witnessed in fascination how it regularly sours and bends to the capricious will of day-traders and algorithmic flash crashes, financial FOMO victims and corporate insiders. Good times in the Skinner box.

…

…

All we need is another crisis to get the Boomers the ammo they need to pressure congress to obligate your wealth and savings to continue to pay for their Viagra, synthetic elbows and hormone-replacement formulas (not that there’s anything inherently wrong with those things). That crisis is right down the street, ready and waiting to happen. Forced austerity will be the last resort when all else fails.

Your parents and grandparents will be taken care of. They vote. They also control most of the wealth outside of the top 1%, where currently the richest 1% controls nearly 40% of all privately-held wealth in the United States. If past studies of human behavior are any guide, they will abandon all sense of fairness and concern for future generations and urge those in power to force you into perpetual indentured servitude. That is, unless you’ve done your planning and have options to exit the system with your ass intact.

…

Old salty Franklin called it two centuries ago. The Republic will fall. It’s just a matter of time. As of now we have 49.5% of the people not paying any federal income taxes while still having the right/privilege to vote; it won’t be long until this number is over 51%, stacking the odds that we’ll collapse as a country or at least cease functioning in the current format.

…

…

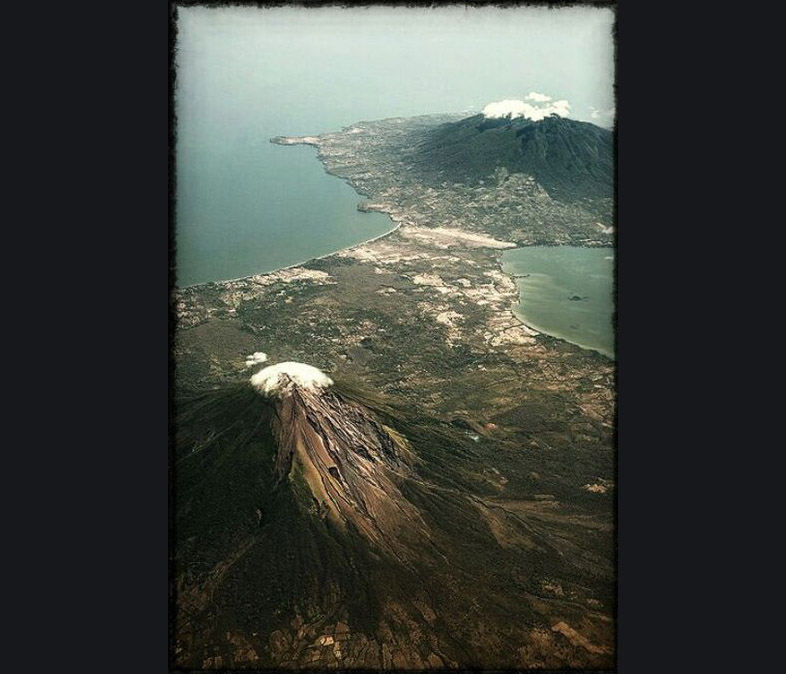

No Mas Olas: Political Ruins of Nicaragua’s Debt Bomb

Surfer’s travel tip of the year: skip Nicaragua. A corruption/debt double torpedo sent the economy underwater. 2018 tore it up and sent it back in time a little bit. An authoritarian ruler has succeeded in subverting a liberal democracy here. Aside from the media’s deconstruction of Daniel Ortega’s tainted agenda, Nicaragua is one of the newer case studies about raided purses and insoluble debt, the freedom it kills, and the instant form of oppression that springs up in the power vacuum it leaves behind. The usual shit-list is on offer: crooked politicians propelled by shameful corruption and bribery, of which the means were supplied alone by the plunder of the public money.

Following nearly 30 years of slowly opening up to the outside world, with its ex-pat dreams and infusions of cash from the burgeoning surf tourism industry (among many other industries), Nicaragua is now a patchwork of paramilitary no-go zones and off limits to all but the most risk-loving travelers. Once blossoming as it began to envision a capitalistic transformation similar to that of Costa Rica, 2018 events have swiftly round-tripped Nicaragua back into a darker age. The mainstream press fails to convey just how difficult life has become since the ruling class cratered Nicaragua’s financial system, but the firsthand accounts from Reddit-using locals make it crystal clear why Nicaragua is suddenly off limits to surfers and anyone else who thought it might become a stable or welcoming companion to their South American plans:

[ REDDIT DISPATCH, LATE SUMMER 2018 ]

“We didn’t feel really in imminent danger but it’s not cool to have your car checked by some guys with covered faces, knives and homemade guns. You’ll never forget the drive out of Managua to the coast. There are roadblocks roughly every 15 to 20 kilometers, and what you read in the news is also happening in the capital. Managua, Masaya, León, Granada—they are no-go zones for us. Sorry for the pun but the coast is officially clear. Luckily we don’t have any craziness going on in terms of politics in this beach location, other than being on the topic of most conversations and how we can assist. Don’t listen to the whitewash from the outside press; it’s a country on the brink of collapse: families getting burned alive, convoys of paramilitaries driving around with AK-47s, and you’re (in a Reddit forum) calling Nicaragua a potential ‘good surf adventure with some special memories’??? Hey buddy, I have in-laws down there. They’ve been barricaded in their house for the last week. The situation is the worst it’s been since the 1980s. Don’t go. Dude I lived there for 12 years. I might have to go get my wife’s family out and I have contacts, friends who know the country and speak Spanish. I don’t look forward to it. A house that was scorched to ashes is a two-minute walk from my mother-in-law’s property. Cops raided the neighborhood trying to break into houses, and laid waste to the place. The in-laws were huddled in the corner of their house while bullets were flying. Five young men were taken that day, and haven’t been seen since…”

…

…

The country is basically primed to go right back to the savagery of the Sandinistas, and it goes to show that even if Ortega were to leave the country, the thugs and social misfits would still remain. And, like Venezuela to the north, it is once again ripe for proxy war.

Nicaragua boasts volcanic landscapes, sensational wave-lashed beaches, colonial architecture, remote idyllic islands and pristine rainforests. Nicaragua is also Latin America’s poorest country after Haiti, with some of the worst United Nations indicators for human welfare. It also recently had the world’s highest level of per-capita debt, a debt that was ironically supposed to break the country out of a poverty trap over the past two decades. The saddest part of this story? Prior to the 2018 meltdown, Nicaragua was one of the least violent, safest countries in Latin America since the Contra War ended in 1988. When Nicaraguan citizens defeated communist comandantes at the ballot box in 1990, it was the dawn of democracy in a country that had rarely known it and the triumph of elected civilian rule in a region long plagued by dictators.

Behind the sensational headlines and political intrigue, what felled Nicaragua was a decisive death blow by debt. Everything described above is a debt reaction chained to a breakdown, in the reviled pattern of a downward spiral—just like Venezuela or any place else that’s not immediately backstopped by a large, systemically-important central bank or too-big-to-fail corporate structure.

…

…

This is the endgame following months of repression under the Nicaraguan authorities, and warranted by widespread protest about President Ortega’s debt-reduction plan to cut pensions and hike social security contributions and the minimum withdrawal age. The resulting counter-movement morphed into a broader protest against Ortega after he directed a brutal crackdown on the opposition, killing hundreds of people… on the low end of the estimate (separately, the country’s body-count data is usually presumed to be on the optimistic side as up to 85% of violent crimes go unreported, similar to Mexico). The anti-regime rage continues to flare up, and begets the usual crimes against humanity on both sides—including arbitrary arrest, manipulation of media and alternative truths, paranoid fantasies, and other grenades thrown by those determined to undermine democracy (a common trait among the key causal players). You’ll start to see the stress-tests of allegiances, when patriotism or government support is seen as perilous: The display of a nation’s flag (on your hat, a balloon, a bumper sticker) is seen as subversive or forbidden, and certain behaviors or other displays are banned in the partisan rancor.

At that point, it’s obvious what has happened: The people talk of a coup, but the real coup d’état has been against the citizens.

When toxic debt implodes the system, politicians often turn cowardly and voters unleash feelings-based tactics that veer into uncharted territory, all of which can be mentally paralyzing. All the hard work to build the cities, highways, power plants, water treatment plants, world-class hospitals, airports, and universities, taming the wild regions and making deserts bloom into oases…only to see the powerhouse behind it all condemned, abandoned and summarily stripped of its contents and copper wiring. What ultimately took centuries to arrive might take less than a month to destroy.

…

…

The children can become ruthless toward the ruling generations, and talk about how their futures were stolen. Good luck trying to unwind that debt-laden mess without being called disgraceful hypocrites, all while watching animus and infighting develop with every gap in basic services, every meal a struggling kid had to skip. People will go on, of course; there will be a spectrum of plan-B actions set up to harvest the resources, tend the roads and infrastructure, and a dissonant simultaneous screech of blaming-begging at the steps of the venture capitalists, World Trade Organization and World Bank. The modern part of the system will have broken, and any hopes for an entrepreneurial influx of new money is barred by the fact that reasonable business-folk detect a cobra in the basket and won’t be touching Nicaragua with a 10-foot pole any time soon.

A few abrupt missteps, a sideslip into debt oblivion, and suddenly Nicaragua’s metaphorically one town away. Rapid, rabid debt accumulation, that moral leveler couched in the progressive desire for “free money,” shows its bleakest side when it goes all chaos-monkey and slave-driver on us.

One thing that is most refreshing about the people of Nicaragua is the rebound of their senses… in 2019 they’re aligned more closely with “It is our fault, we allowed this to happen. The responsibility is ours, collectively.” And on this particular point of societal guilt and call-to-action, they actually stabilize while the United States seems delayed in its reckoning despite our magical technology, having been lapped by the refreshing honesty of a busted banana republic.

…

…

Conclusion: Vicious Dividends of Globalized Intransigence

Neither Democrats nor Republicans want to eliminate the ballooning debt, lest they receive blame for the pain. On a global scale, the very identity of our debt seems like an illusion, a fever dream about some disordered nebulae in a distant galaxy. Back on Earth, we are beginning to look mutually destructive in this scenario. And as the far right and the far left gain strength and polarize any nation, that nation inevitably finds it increasingly difficult to get things done. The inability to tame runaway debt resides in the liminal space between the support for—and backlash against the downside of—a more globalized economy where policies do not work equitably.

In looking at the primary institutions that promote globalization, we see how the WTO is growing hobbled by divisions undermining its ability to police international commerce disputes; the United Nations attempts to set global migration guidelines and 12 nations recoil, arguing it undermines their sovereignty; and the vanguard of cross-border economic harmonization, the European Union, is losing one of its cornerstone members when the UK concludes its Brexit later this year. Amid the disconnection, trade tensions and lowered economic output, the 27 remaining EU countries are witnessing a rising front of Euroskeptics who want to turn back the clock on European integration, as detailed in multiple analyses across the full political media spectrum.

Clearly, globalization—the smooth flow of goods, labor and capital across borders—faces messy existential conundrums and intensifying headwinds in 2019 and beyond. In this atmosphere, it becomes harder to justify the long view or craft responses to complex debt traps that demand inquiries into the dubious nature of fiat currency. Greece found out the hard way—after plunging into a debt-strewn malaise of economic depression and crippling austerity imposed by international creditors, now foreigners are buying up lots of property (to access EU citizenship), displacing multi-generation locals who are priced out. Despite the suspicions and outcry from citizens and nationalist-populist movements, international economic integration shows no signs of collapsing yet, as it did during phases of outright deglobalization. From 1914 to 1945—a phase scarred by two world wars and the Great Depression—trade plunged from 38% of global economic activity to 7%. We’re more resilient today, but the debt over our shoulder, in the periphery, is an unanchored ship ripped from its safe harbor and headed directly for the reef.

…

…

If you had a seat at the Davos Forum, if you had the power to solve the impossible debt burden or some of the world’s other pressing issues, if you had command of the necessary resources, workforces and energy—what would you do? Are you optimistic about the economic view for the future? Because as for society and how we will get along, let alone solve intractable levels of debt, many see worsening divisions ahead. Excessive capitalist credit crunches invoke extreme socialist counter-responses, so no one’s fully on or off the hook for creating this circular problem. Such maneuvers introduce the last step in a bleak dénouement for free-market capitalism when the new moral majority, embittered by the age, scrapes money out of the so-called productive class to mend the insolvency. A group that once cooperated senses how the ambient IQ drops on both sides while political vengeance is slaked.

While the debt may drown out the ability to have a functioning economy, most people are obsessed with meta-issues that only look like the main issues at the surface: The vanishing middle class; energy and the environment; trade and immigration; contending with extremism and terrorism; hostile nations with nuclear arsenals; the impact of artificial intelligence and automation on the job market; all the way on down to internet data privacy and cyber threats. These things all rank highly on the threat matrix, and none of it can be approached effectively within the framework of overpopulation and over-consumption married to a broke financial system.

If we are crossing over a threshold we cannot escape, pushed by a debt we cannot placate, then perhaps it’s warranted to swig a few legendary quotes, steel the resolve and remind ourselves about the royal tug-of-war between poverty traps, debt traps, establishment life cycles, and the everlasting tension between capitalism and socialism:

. . . … . . .

“I am for doing good to the poor, but…I think the best way of doing good to the poor, is not making them easy in poverty, but leading or driving them out of it. I observed…that the more public provisions were made for the poor, the less they provided for themselves, and of course became poorer. And, on the contrary, the less was done for them, the more they did for themselves, and became richer.” ― Benjamin Franklin

.

“The average age of the world’s greatest civilizations has been 200 years. These nations have progressed through this sequence: From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.” ― Alexander Fraser Tytler

.

“It is not, perhaps, unreasonable to conclude, that a pure and perfect democracy is a thing not attainable by man, constituted as he is of contending elements of vice and virtue, and ever mainly influenced by the predominant principle of self-interest. It may, indeed, be confidently asserted, that there never was that government called a republic, which was not ultimately ruled by a single will, and, therefore, (however bold may seem the paradox,) virtually and substantially a monarchy.” ― Alexander Fraser Tytler

.

. . . … . . .

[ get out of debt and the world is yours ]